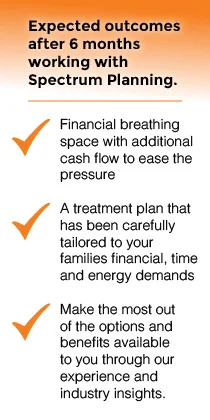

During this initial stage in your journey, we hope to be a hand that leads you out of those feelings of chaos, by guiding you through funding options as you plan for short term needs including, therapy, personal time management, and emotional support and respite for the family.

When you are just discovering that your child has special needs, it can be difficult to find the time and emotional energy to do much at all, apart from surviving day to day. Immediate treatment and funding options are all very new and confusing. The stress can feel overwhelming, compounded by additional time pressures.

However, it is important to start making plans as soon as you can so that you can begin to take action, and regain that sense of moving forward.

Needless to say, one of the biggest questions raised in the beginning stages of the journey is, ‘ How are you going to finance raising a child with special needs?’. The new expenses imposed on your family may seem crippling but, be assured, there are options. The key is to plan ahead, specifically by:

Reviewing your current situation and managing short term requirements

Step 1: Assess your family’s general priorities and needs for respite and emotional support

Step 2: Get a fuller picture of your family budget

Step 3: If you have a mortgage, restructure your repayments to provide short term cash flow relief, and ensure that your loan facility has flexibility for additional capital drawdowns in the future

Exploring all your funding options and optimising your situation

Medicare, Centrelink, Fahcsia and Private Health Funds are all potential sources of funding. We can help you navigate the maze and get the most out of them.

Centrelink benefits can be particularly difficult to understand, but there are strategies that can allow you to maximise your benefits. The process of optimising your situation depends on a number of factors, including your income and asset position.

Assessing Treatment Options and Creating a Tailored and Realistic Treatment Plan

From our experience, a lot funding can be wasted without a realistic plan. Initially, there can be a tendency to try to do too much therapy at once, leaving everyone exhausted and confused about what therapies are actually working. Parents need to be conscious of constraints on time and energy when they choose the therapies for their child, and they need to carefully consider what therapies should be given first priority. We can point you to invaluable resources to help you do this.

Working with you and your other professionals, we can guide you as you plan and prioritise for your whole family, so that your course of action really makes a difference.

Managing your finances

Restructure your debt in 2 phases:

If you have a mortgage, the best option for the short term is to restructure your loan.

1. Move immediately to an ‘interest only’ home loan improving cash flow and providing breathing space.

2. Restructure debt by increasing credit master limit to increase medium term flexibility and seek improved terms

Funding options:

Family tax benefit from centrelink.

To maximise your centrelink benefits, the key is to adjust your tax income to be less than $150,000.

You will then benefit from the Carers payment and Carers allowance.