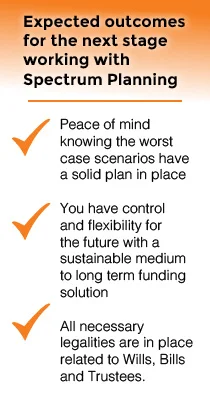

Having addressed and begun working on some of the immediate issues, it is now time to consider how to provide for and to protect your family from some of those scenarios that you find yourself worrying about in the middle of the night.

The ‘what ifs?’

‘What if something happened to either of you or both of you?’

There are number of estate planning matters that you can explore to ensure that your loved ones will be taken care of. Structures can be set up to protect future benefits such as the Disability Support Pension, that your child may be entitled to. In addition, there are documents that will ensure that your family will be looked after in the best way possible, including Special Disability Trusts, Testamentary Trusts and Letter of Wishes.

‘What if there isn’t enough money if someone gets sick or passes away?’

Adequately protecting your family requires a full review of your insurances. If you suddenly became a single parent, you would have a significant additional load to carry.

Special needs families need to consider the treatment costs , plus all the future needs, not just of your special needs child, but of the rest of your family. Risks can be managed through a careful review your future requirements.

‘What if my super fund can actually help with our cash flow?’

Superannuation is something that is often ignored but it can potentially provide funding for insurance, and can even be considered for funding therapy needs. In addition, many people aren’t aware that a ‘family’ or ‘self-managed’ super fund can provide additional flexibility that other public offer funds can’t.

Wills and other legal formalities

Estate Planning

Wills

- Testamentary trusts

- Education fund

- Guardians for children

- Memorandum of wishes (financial)

- Special Disability Trust

Other Considerations

- Enduring Powers of Attorney

- Enduring Powers of Guardianship

- Letters of intent (lifestyle)

To wrap up the estate planning process you are looking at a rough cost of approx $2,500 to $6,000 (one off payment)

Insurances

Term Life

- Tax free lump sum

- Low Cost cover

- Repay debts, support family

Critical Illness

- Tax free lump sum

- More expensive cover

- Covers specific illnesses

- Medical costs and choice

TPD

- Tax free lump sum

- Low Cost cover

- Own or Any occupation

- Repay debts, support family

Income Protection

- Taxable monthly benefit

- Up to 75% of income

- Expiry date to 65

- Tax deductible cover

- Replace valuable income

Superannutation

Funding through Super